Navigate your Retirement Goals with Guaranteed Income

KSKJ Life Single Premium Immediate Annuity

SPIA Series

A KSKJ Life SPIA provides the ease and simplicity of a one-time premium payment along with multiple payout options to meet your needs.

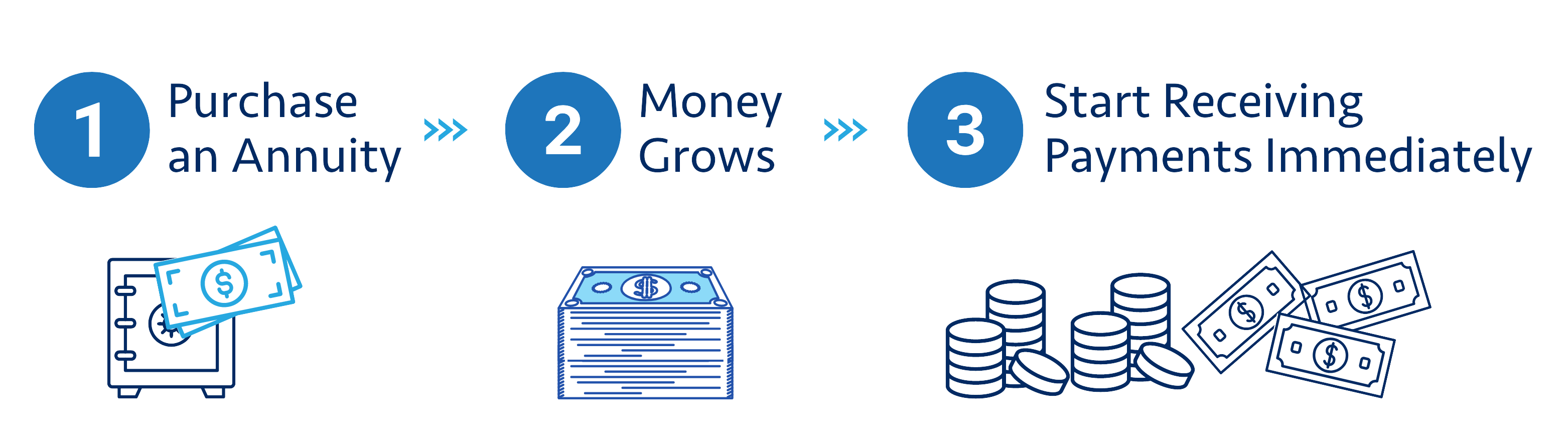

HOW DOES AN IMMEDIATE ANNUITY WORK?

What are your retirement goals?

Asset Preservation-A SPIA allows you to convert a portion of your assets into a guaranteed income stream, ensuring that your wealth continues to work for you during retirement.

Maximizing Social Security Benefits-Create your own “social security” or “pension” plan with a KSKJ Life SPIA to receive immediate monthly income while your Social Security benefits continue to grow*.

Guaranteed Income for Life-A KSKJ Life SPIA offers multiple payout options, including Period Certain and Life, which will continue to pay out for as long as the annuitant lives.

A Predictable Income to Cover Everyday Expenses-A KSKJ Life SPIA provides the stability of knowing exactly how much you’ll receive each month to help manage your budgeting.

Protecting Your Retirement Income from Market Volatility-A KSKJ Life SPIA can shield your income from the market ups and downs, helping to ensure that your financial future remains stable, no matter what happens in the markets.

Checking Off Your Bucket List-A KSKJ Life SPIA can provide you with a guaranteed “play-check”, allowing you to purse your dreams – whether it’s traveling the world or taking up new hobbies.

Need help planning for retirement? Connect with us today!

Minimum and maximum deposit limits exist. Issue ages vary. Surrender charges may apply. Not FDIC Insured. Not available in all states. Annuity products not available in California. Guarantees rely on the financial strength and claims-paying ability of KSKJ Life. Early withdrawals and those made prior to age 59 1/2 may be subject to IRS penalty. We are not tax or legal advisors – Please contact a tax or legal professional regarding the law concerning tax and retirement plans. Forms: ICC24-SPDA 0324, FPDA 2011 (including various state versions) and SPIA 1/94.