Fund your Future Retirement Plans With

KSKJ Life’s Compass Annuity

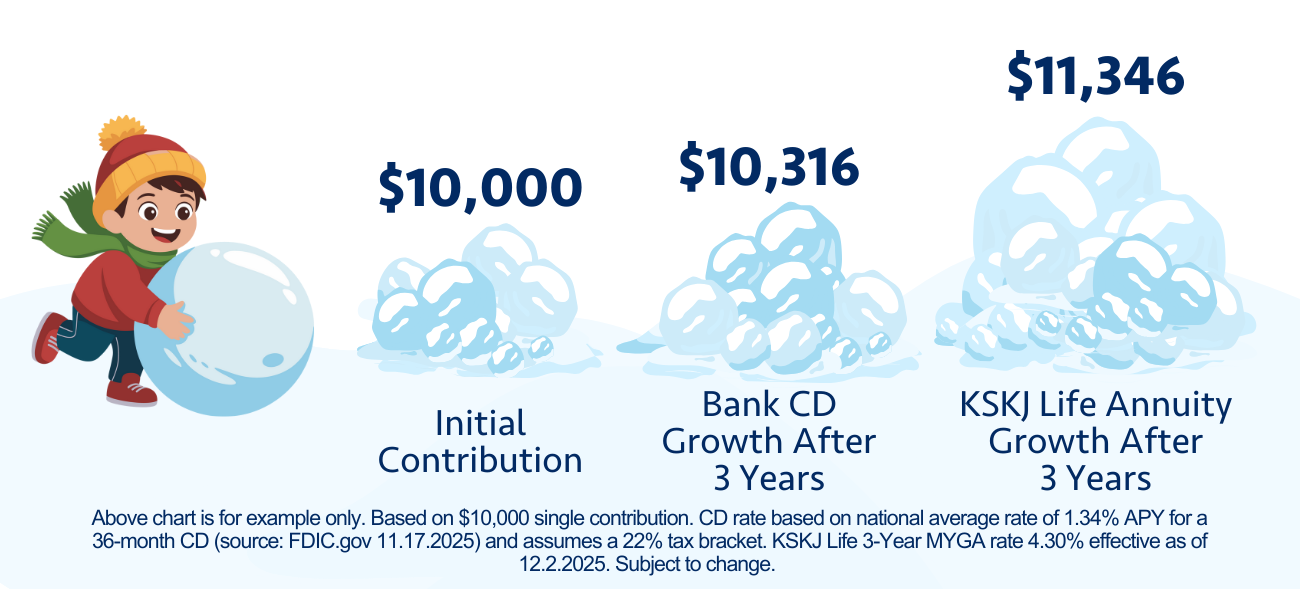

How much could $10,000 grow?

Compare the earnings

potential!

Multi-Year Guaranteed Annuity* & Flexible Premium Deferred Annuity

MYGA Series | FLEX Series

Rates up to 5.45% APY**

The KSKJ Life MYGA and FLEX Series provide a secure way to grow your savings over time with tax-deferred growth.

Multi-Year Guaranteed Annuity

-A guaranteed fixed interest rate for the entire guarantee period, with choices from 2 to 10 years

-Free Enhanced Benefit feature for a terminal illness diagnosis or nursing home confinement

-Automatic renewal feature

-Optional riders

Ideal for: Those seeking secure, predictable growth on their savings.

Flexible Premium Deferred Annuity

-Offers a one or two-year bonus rate

-Allows for additional contributions after initial premium

Ideal for: Those who want flexibility to build their retirement fund over time.

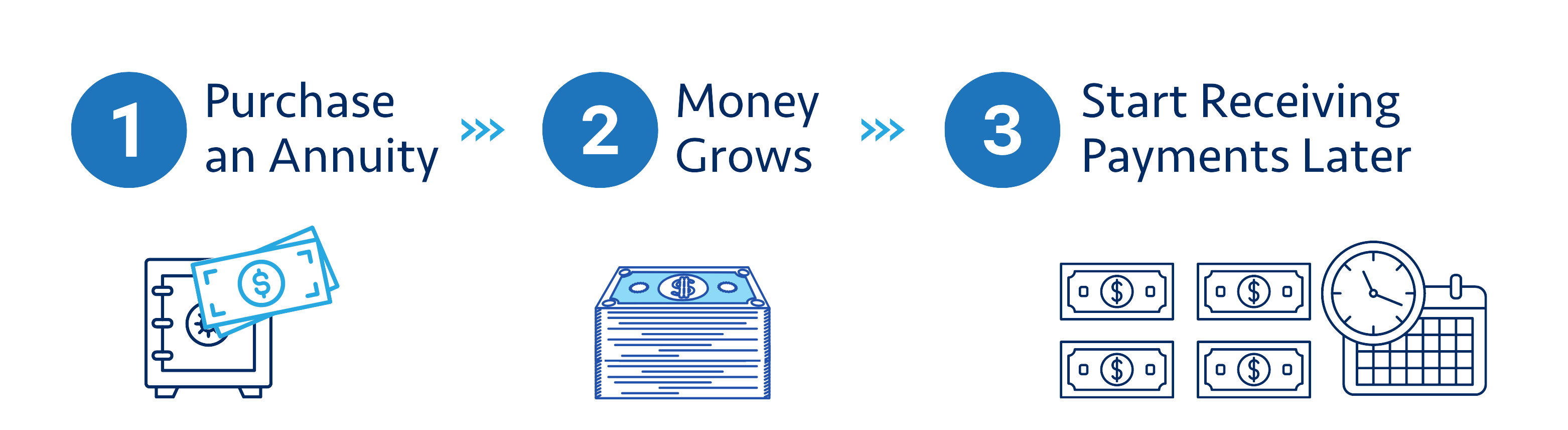

HOW DOES A DEFERRED ANNUITY WORK?

What are your retirement goals?

Tailoring Your Savings to Your Timeline-Our MYGAs offer flexibility with terms ranging from 2 to 10 years, allowing you to choose the duration that best fits with your goals.

Securing a Competitive Rate-With a KSKJ Life MYGA, you can lock in a competitive interest rate for a set period.

Building a Solid Foundation for Your Retirement Income-A KSKJ Life MYGA can help you build a strong financial foundation by offering fixed returns, providing stability.

Achieving Tax-Deferred Growth on Your Savings-A KSKJ Life MYGA allows your savings to grow tax-deferred, maximizing your growth potential while delaying taxes until you withdraw the funds.

Avoiding Market Volatility While Still Earning Interest-Our MYGA offers the best of both worlds: protection from market fluctuations and a guaranteed interest rate.

Preparing Yourself for Future Wants and Needs-A KSKJ Life MYGA allows your money to grow over a defined period, making it easier to plan for upcoming expenses or retirement bucket-list items.

Add Additional Funds to Your Annuity Over Time-Our FLEX annuity offers the ability to deposit more funds over the life of your annuity.

Are you looking to lock in higher rates with a deferred annuity? Request a free, no-obligation consultation with a KSKJ Life agent today!

*KSKJ Life MYGAs (Multi Year Guaranteed Annuities) are multi-year, single deposit deferred contracts with a guaranteed interest rate for the term of the contract (ranging from 2 to 10 years), after which the current renewal rate will apply. ** 1Advertised rate(s) effective as of 12/2/2025 and is on the 8, 9 and 10-year MYGA and subject to change and reviewed frequently. Minimum and maximum deposit limits exist. Issue ages vary. Surrender charges may apply. Market Value Adjustments (MVA) apply to the full amount of surrender that is in excess of any free withdrawal during the multi-year guarantee period. Not FDIC Insured. Products may not be approved or offered in all states. KSKJ Life annuity products not available in California. Guarantees rely on the financial strength and claims-paying ability of KSKJ Life. Early withdrawals and those made prior to age 59 1/2 may be subject to IRS penalty. We are not tax or legal advisors – Please contact a tax or legal professional regarding the law concerning tax and retirement plans. KSKJ Life MYGA form ILCC24-SPDA 0324. KSKJ Life is an Illinois fraternal benefit society located at 2439 Glenwood, Ave., Joliet IL 60435 1-800-843-5755. Life Insurance and Annuities.