January 28, 2025

Social Security and Retirement Planning: Answers to Your Top Questions

Navigating the complexities of Social Security is essential for a financially secure retirement. Whether you are pre-retirement and want to better understand Social Security or are already receiving Social Security and want to make sure you’re getting the most out of your benefits and savings, it’s important to know your options.

At KSKJ Life, we’re committed to providing you with clear and concise information to help you make informed decisions. Below, we address some of the most frequently asked questions about Social Security*, annuities, and how to maximize your savings to achieve your retirement goals.

The Social Security Basics

1. What is Social Security, and how does it work?

In simple terms, Social Security is a federally funded pension plan for Americans to utilize in their retirement years. The amount you receive from Social Security depends on two main factors: (1) your earnings history and (2) what age you decide to start claiming your Social Security benefits.

2. When can I start receiving Social Security retirement benefits? Should I take benefits early, or is it better to wait?

2. When can I start receiving Social Security retirement benefits? Should I take benefits early, or is it better to wait?

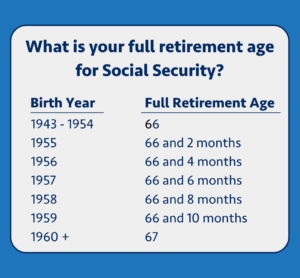

You can start receiving Social Security retirement benefits as early as age 62. However, claiming benefits before your full retirement age (FRA) will result in a reduced monthly amount. Your FRA varies depending on your birth year. If you delay taking your Social Security benefits until after your FRA, you can increase your monthly benefit up to age 70. Check your eligibility for Social Security benefits on the SSA website.

There may be benefits to taking your Social Security benefits early or delaying them depending on your unique financial needs. You should talk with a financial representative to determine what’s right for you. Annuities can be one strategic tool to help complement your Social Security benefits to maximize your retirement income. See more details in the annuities section below.

3. How are my Social Security benefits calculated?

Benefits are calculated based on your highest 35 years of earnings, adjusted for inflation. If you have fewer than 35 years of earnings, this can lower your benefit amount. The Social Security Administration (SSA) uses a formula to determine the benefit you’ll receive at your FRA; see the SSA’s online calculator here.

4. Can I work and still receive Social Security benefits?

Yes, you can work while receiving Social Security benefits. However, if you haven’t reached your FRA, your benefits may be reduced if your earnings exceed certain limits. The year you reach your FRA, a higher limit applies, and once you reach your FRA, there are no earnings limits.

5. Are Social Security benefits taxable?

Depending on your income, your Social Security benefits may be subject to federal income tax. To find out if your Social Security benefits are taxable, the IRS provides a tool on its website.

6. How do I apply for Social Security benefits?

You can apply for benefits online through the SSA’s website, by phone, or by visiting your local Social Security office. It’s recommended to apply three months before you want your benefits to start.

7. What happens to my Social Security benefits if I die?

Survivor benefits may be available to your spouse, children, or dependent parents. The amount depends on your earnings and the survivor’s relationship to you. For example, a surviving spouse can receive full benefits at their FRA or reduced benefits as early as age 60. Dependent children may also be eligible for benefits until they reach age 18.

8. Do Social Security payments go up in response to inflation?

Social Security benefits are adjusted annually to keep pace but may not fully match inflation. For example, in 2025, benefits increased by 2.5%.

9. Where can I find more information or get help with my Social Security questions?

For more detailed information, visit the SSA’s official website or contact them directly. Additionally, consulting with a financial advisor can provide personalized guidance tailored to you and your unique needs. Understanding Social Security is a crucial component of your retirement planning. At KSKJ Life, we’re here to support you in making informed decisions for a secure and fulfilling retirement.

Social Security + Annuities: Unique Benefits to Maximize Your Retirement Income

1. Is Social Security enough to live on in retirement? What percentage of my pre-retirement income does Social Security cover?

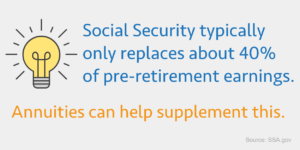

Social Security was never meant to be the only source of income for people when they retire. Most financial advisers say you will need about 70% to 80% of pre-retirement income – including your Social Security benefits, investments, and personal savings – to live comfortably in retirement. Social Security typically only replaces about 40% of pre-retirement earnings.

2. Can annuities help supplement Social Security income?

2. Can annuities help supplement Social Security income?

Yes, annuities can serve as a reliable income source to complement your Social Security benefits. An annuity is a financial product that provides regular payments over a specified period or for life, depending on the type of annuity you choose. By creating an additional income stream, annuities can help bridge the gap between your Social Security benefits and your financial needs in retirement.

3. How can annuities help protect against outliving my savings?

One of the main benefits of annuities is they can provide income for life. With a KSKJ Life Single Premium Immediate Annuity (SPIA), you receive regular payments for a set period of time for as long as you live. This makes annuities a valuable tool to mitigate longevity risk – the possibility of outliving your savings – while ensuring you have financial security alongside your Social Security benefits.

4. What types of annuities are best for supplementing Social Security?

The right type of annuity depends on your goals and financial situation. Here are some common fixed annuity options that we offer at KSKJ Life. They provide a guaranteed income and are ideal for those who value stability and predictability:

- Immediate Annuities – Income Now: Immediate annuities start paying out income soon after a lump-sum payment is made, making them a good option for retirees needing immediate cash flow.

- Deferred Annuities – Income Later: Deferred annuities allow you to make a contribution now and receive payments later, offering growth potential and future income security.

You may also want to explore an annuities “laddering” strategy and put money into multiple Multi-Year Guaranteed Annuities (MYGAs), which can provide greater liquidity, flexibility, and the potential to redirect funds at potentially higher future interest rates.

5. Can I use part of my retirement savings to purchase an annuity?

Yes, many retirees use funds from their 401(k), IRA, or other retirement accounts as well as from a savings account to purchase an annuity. By converting a portion of your savings into a guaranteed income stream, you can create a predictable cash flow that works alongside your Social Security benefits. Be sure to consult with a financial advisor or insurance agent. If you need help finding an agent or have questions around annuities, we’re happy to help.

Ready to Learn More? Get Proactive About Retirement Planning

To learn more about key retirement considerations around your Social Security benefits and help you better plan, check out our Social Security Guide . The new year is a great time to take stock of your financial situation and future retirement goals.

For more information on retirement planning and annuities, visit our Retirement Solutions page or read more about the benefits of an immediate annuity and maximizing retirement income now or retirement income later, depending on your needs.

Click here to see our current annuity rates.

*The Social Security information provided above was obtained from the Social Security website ssa.gov as of January 2025. We are not tax advisors or financial planners. KSKJ Life does not provide investment advice and this material is not intended to provide investment advice.