January 27, 2023

Life has a way of going in unexpected directions

Sometimes, it can completely change the course of our life which is nothing anyone wants to think about. But the reality is, life happens. It’s a risk that comes with being human and loving others.

Jeannie’s and Tom’s real-life story illustrates this truth. As a young couple starting out, Tom had the conversation with Jeannie about life insurance early on. Losing your spouse is not necessarily at the forefront of your mind, especially while you’re starting a family. But, having the conversation about life insurance matters even if it feels uncomfortable or unimaginable because none of us know when that last time might be. For Jeannie, her unexpected unfortunately happened. Her life, despite her loss, had changed; but think about how different it would have been had she and Tom not decided to protect each other with life insurance. By setting up a financial means of security like life insurance, we can help those we love after we are gone. No one would choose for their family to struggle to carry on after loss. Not only is life insurance an expression of love, but it also shows your love for them and that you care about guarding their future.

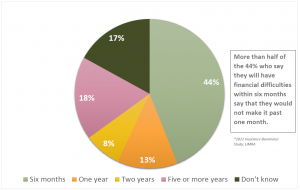

Time to Financial Hardship if a Primary Wage Earner Dies

According to the 2022 Insurance Barometer Study1 conducted by the Life Insurance and Research Association (LIMRA), life insurance is a key element in feeling financially secure. Among insureds with financial dependents, 68 percent feel secure, compared with 47 percent of non-insureds.

Watch a short video of how planning for the unplanned protected Jeannie and her family:

So go ahead, have the conversation you don’t want to. Take the action. Get the insurance. Then rest more easily. There can be peace behind a well-prepared plan for you and those you love.

Learn more about how to protect your family with the simple act of life insurance with one of our KSKJ Life insurance plans by clicking HERE.

1. An annual study that tracks the perceptions, attitudes, and behaviors of adults (aged 18 – 75) with particular focus on life insurance in the United States. LIMRA 2022 Barometer Study

Looking for information on a life policy with KSKJ Life?

Connect with us today!