December 30, 2024

New Year, New Financial YOU: A Smart Start to 2025

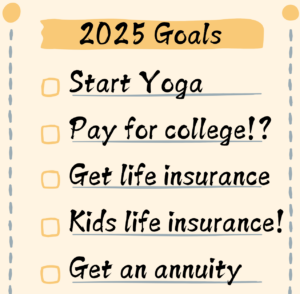

The start of a new year is the perfect time to press the reset button—not just on health goals or personal ambitions but on your finances, too! Think of it as a chance to sweep out the cobwebs, sharpen your strategy, and set yourself up for a financially fit year. Here’s your go-to checklist to kick off 2025 on the right foot, complete with ideas to help you make the most of KSKJ Life’s line of financial products.

1. Take Stock of Your Current Financial Picture

Before you can plan ahead, it’s important to know where you stand.

– Review your bank accounts, investments, and outstanding debts.

– Check your credit score and credit report for accuracy.

– Look at last year’s spending habits. Where can you save more?

Pro Tip: Have funds sitting in savings? Consider a KSKJ Life Multi-Year Guaranteed Annuity (MYGA) to earn competitive interest rates. It’s a smart way to grow your money safely over time.

2. Set Clear Financial Goals

What do you want to achieve this year?

– Build an emergency fund (aim for 3–6 months of expenses).

– Start or max out your retirement savings.

– Plan for big expenses like a vacation, home renovation, or college tuition.

Hint: If you’re eyeing predictable monthly income, a KSKJ Life Single Premium Immediate Annuity (SPIA) could be the key to securing peace of mind. It’s “income you can’t outlive”—perfect for retirees or those nearing retirement.

3. Get Insured and Stay Protected

– Life happens—sometimes unexpectedly. Are you prepared?

– Review your life insurance policies to ensure your loved ones are covered.

– Consider adding a KSKJ Life Precision Plan whole life policy.

4. Minimize Debt, Maximize Savings

4. Minimize Debt, Maximize Savings

– Create a plan to tackle high-interest debt first.

– Automate monthly savings to keep your goals on track.

Take advantage of products that grow your money faster, like our MYGAs designed for specific timelines and financial needs.

5. Review Your Long-Term Strategy

When was the last time you revisited your financial plan?

– Schedule a meeting with your financial advisor* or one of our agents to review your progress and adjust your plans.

– If you’re managing Required Minimum Distributions (RMDs), consider how you can use them effectively—like funding a SPIA for predictable income that starts right away or using the distribution for the purchase of a KSKJ Life MYGA.

6. Take Advantage of Member Benefits

As a KSKJ Life member, you have access to a host of benefits beyond our financial products. From discounts on everyday items through PerkSpot to wellness perks like YogaVista.TV, our benefits are here to help you live well without overspending.

Ready to Make 2025 Your Year?

Whether it’s securing your financial future, building a safety net, or finding ways to grow your savings, we’re here to help. Connect with us today to learn how our suite of products and services can turn your resolutions into reality.

Let us help you achieve your 2025 financial goals.

Fill out the form below to schedule a chat with one of our agents today!

*We are not financial planners or tax advisors. Please consult with a financial planner concerning investment products.