March 21, 2022

YOU HAVE OPTIONS!

If you have a CD coming due, you may be tempted to just leave it in the bank and let it roll over.

One drawback with doing this is that you may not get the same rate as you originally did. Over a period of time, the rates could fluctuate. By leaving your money in the CD, you take a chance in receiving a lower interest rate.

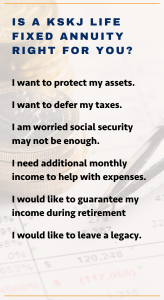

Consider an Annuity

So what can you do if you decide to close the CD? One option is to take that money and purchase an annuity. Annuities may sound mysterious, but they are actually simple and straightforward. An annuity is a financial product for people who wish to make sure that they are going to have enough money to last them for the rest of their lives, offers reliable returns on tax-deferred funds and are typically used as an alternative to a CD. These financial instruments remain one of the most appealing forms of retirement safety today. Many annuities offer options to help protect your money from losing value, which means you’ll be more likely to maintain the lifestyle you’ve worked for. It can be structured to release payments for a fixed number of years to you or your heirs or for the rest of your lifespan.

While a CD and an annuity are similar in the fact that they earn a guaranteed interest rate for a specific period, there are two main differences: 1) Fixed annuities are tax-deferred, 2) Annuities typically provide a higher return than a CD.

As retirement approaches, you may worry about how to protect yourself from outliving your savings. Annuities may be the right choice for you. Contact us today for more information!

*KSKJ Life annuities are not FDIC insured. We are not tax advisors or financial planners. KSKJ Life does not provide investment advice and this material is not intended to provide investment advice.

Looking for information on an annuity with KSKJ Life?

Connect with us today!