March 10, 2025

Retirement and the Economy: How Does Inflation Affect Retirement Savings?

Evaluating the Best Retirement Options in an Uncertain Economy

If you’ve been following the news, you’ve likely seen headlines about inflation, interest rates, tariffs, and economic shifts. What do these changes mean for 2025—and more importantly, for your retirement?

At KSKJ Life, we monitor financial trends to help our members make informed retirement decisions. With over 130 years of experience, we’ve weathered many economic ups and downs, giving us a unique perspective on how to protect and grow retirement savings in changing times.

No matter where you are in your retirement journey—whether you’re a few years away, recently retired, or a decade out—you’re likely keeping a close eye on economic conditions. Below, we’ll explore the 2025 market outlook, how inflation impacts retirees, and potential strategies to help safeguard your savings while managing market risk.

2025 Market Outlook: Is Inflation Back?

2025 Market Outlook: Is Inflation Back?

While opinions on the economy vary, one thing is clear: inflation rose higher than expected in January 2025. In response, the Federal Reserve has temporarily paused planned interest rate cuts, opting to keep rates elevated longer to curb inflation. Though the Fed still anticipates inflation cooling down, it may take longer than previously expected and some predict a second wave of inflation later this year.

For retirees, this means ongoing financial uncertainty. Everyday expenses—housing, gas, and groceries—continue to rise, stretching fixed incomes. Additionally, with potential tax policy changes on the horizon, it’s crucial to consider how different financial strategies might impact your tax situation.

How Current Economic Conditions Will Affect Retirement Savings

Today’s retirees are living longer, but many worry about outlasting their savings. According to the Society of Actuaries’ Retirement Risk Survey, 78% of pre-retirees and 58% of retirees cite inflation and rising expenses as top concerns.

With interest rates expected to remain steady at slightly higher levels for a limited time, it may be a good time to lock in a longer-term financial solution like an annuity that can offer stable returns and protection against market volatility, making them a good option for those looking to preserve and grow their retirement funds.

CDs vs. Annuities: What Makes Sense During Inflation or Economic Uncertainty?

When inflation rises, certain financial products may not keep pace. Certificates of Deposit (CDs), for example, may not be the best place to put your money because they may not outpace inflation, reducing your money’s purchasing power over time. Annuities, on the other hand, often provide a stronger combination of growth potential and security. Unlike CDs, annuities offer several advantages, especially during periods of inflation:

-Higher interest rates

-Defer taxes until you withdraw funds

-Some annuities can provide guaranteed income for life, helping mitigate the risk of outliving your savings

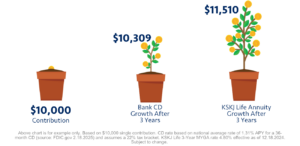

See below for a few real-life comparisons between CDs and annuities:

Why Retirees Say They Favor Annuities

Ultimately, if you’re unsure about the stability of interest rates and the market, an annuity is one thing you can trust. Similar to the guaranteed income assurance of a pension, annuities offer a powerful way to help grow and protect your savings while helping to ensure financial security for the future.

Some of the reasons retirees say they favor an annuity include:

Some of the reasons retirees say they favor an annuity include:

-A locked in, set rate

-It’s a “safe purchase” – lower risk

-It provides protection from losing the money they contributed

-Can provide a monthly paycheck for life

-It takes the guesswork out of budgeting

-Customizable – different types and timeframes meet unique needs

Beyond this, annuity owners feel more secure financially in retirement: 93% say they’re confident in how they’ve prepared for retirement. And they’re happier: they’re 51% more likely to report lower levels of stress and they’re less worried about running out of money.

At KSKJ Life, we offer annuities with flexible terms (ranging from 2 to 10 years) to help meet different retirement needs. Generally, the longer the annuity term, the higher the interest rate you can lock in.

Why Choose KSKJ Life for Your Retirement Solutions?

As a not-for-profit fraternal insurance company, KSKJ Life has been helping families achieve financial security for over 130 years. We understand the unique concerns of today’s retirees and offer solutions tailored to evolving economic conditions. Our annuity options are designed with your financial well-being in mind, helping you to enjoy retirement with confidence.

For more information about retirement planning and annuities, explore our latest blogs:

- Social Security and Retirement Planning: Answers to Your Top Questions

- Smart Financial Move in Uncertain Times

- Smart Retirement Planning for Immediate Income

- How to “Ladder” Your Savings with a Multi-Year Annuity

Visit our retirement solution pages to learn more about our Income Now and Income Later annuity options and how they may fit into your financial plan.

Want to jump start your retirement savings NOW?

Complete the information below to connect with one of our experts to learn more!