July 31, 2022

Life moves fast. If you have children, you know it moves at warp speed. Before you know it, that sweet newborn you’re snuggling is grown up and headed off to college. That milestone that felt so far off is now knocking at your door. The car is packed, and the sheets and textbooks are bought. But have you thought about packing up the life insurance too? It’s very likely you also took out a student loan to help fund this next step. If you’re a co-signer on a private student loan or have taken on any shared financial responsibility with your college-bound student, you might want to consider a life insurance policy for him or her. Without it, you could be left with unforeseen debt you hadn’t planned on should anything unfortunate happen.

Understanding the need and the why

Buying life insurance for your child is not a usual practice but “sixty-nine percent of college students from four-year universities graduate with an average of $29,650 in student loans.”1 No one likes to think about the unthinkable. However, should something tragic happen to your child, depending on your lender, you will still be held responsible for paying off that debt if:

1) You co-signed on a private loan via a bank or other financial institution like a credit union or other lender.

2) There is an unpaid balance remaining on the loan.

Some student loans, including federal student loans, are discharged when the borrower dies. There is one federal loan, the Parent PLUS, that is discharged “if either you or your child die, but the canceled debt is treated as taxable income.”1 This might end up costing you an additional tax bill you weren’t planning on having.

Private loans create different situations. These are not automatically discharged. Policies will vary by lender but it’s possible your loan could go into automatic default meaning it would need to be paid immediately – another unplanned cost that could cause distress and disrupt your family’s finances.

Now you understand the why, so what next?

Now that you understand why a life insurance policy is needed for your college student, you have a few options.

Term life insurance, which is a policy that only exists for a specific amount of time, is a good fit for college-bound kids. Policies are usually 10, 20, or 30 years. “After the policy ends, you’ll no longer receive a death benefit and you won’t have to pay premiums anymore (unless you opt to convert the policy to a permanent whole life policy).2 To determine how much you’ll need and the cost, you will need to consider your child’s: AGE, HEALTH, COVERAGE AMOUNT AND LENGTH. Premiums vary based on these factors and term life insurance usually costs less than whole life insurance.

Whole life insurance is another option. Premiums are usually higher, but the policies can accumulate cash value.

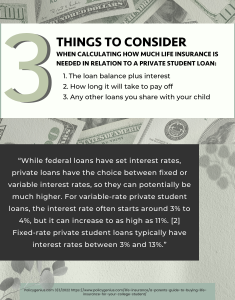

How do you calculate how much life insurance is needed in relation to a private student loan? Consider these three points:

1) The loan balance plus interest

2) How long it will take to pay off

3) Any other loans you share with your child

“While federal loans have set interest rates, private loans have the choice between fixed or variable interest rates, so they can potentially be much higher. For variable-rate private student loans, the interest rate often starts around 3% to 4%, but it can increase to as high as 11%. [2] Fixed-rate private student loans typically have interest rates between 3% and 13%.”1

Whichever option you choose, take note of the fact that you will need your student’s permission as well as proof of insurable interest. Insurable interest means that “you would experience a financial loss if your child died. Your cosigned loan documents should be sufficient as proof of insurable interest.”2

So, after you hit the Bed, Bath and Beyond and set up that dorm room, you might also want to consider where you stand on life insurance before you hit campus. KSKJ Life offers both Term and Whole Life policies to help you navigate thru this next big step for both you and your new inbound collegian.

Check out what KSKJ Life options will work best for you!

1 Policygenius.com 3/3/2022 https://www.policygenius.com/life-insurance/a-parents-guide-to-buying-life-insurance-for-your-college-student/

2 Bankrate.com 2/23/2022 https://www.bankrate.com/insurance/life-insurance/buying-life-insurance-for-college-students/

Insurance products from KSKJ Life are subject to underwriting. Not available in all states. We are not financial advisors. Please consult with an advisor or lender about student loans.

Looking for more information on a policy with KSKJ Life?

Connect with us today!