February 19, 2025

PROTECTION FOR YOUR LOVED ONES

Just Got a Little Sweeter

Understanding Life Insurance Policy Dividends

When people think about life insurance, they often focus on the primary benefit: providing financial protection for their loved ones. But with a participating whole life policy like KSKJ Life’s Precision Plan Plus, there’s an extra feature that offers additional value – dividends. Here’s how they work and what they can mean for you.

When people think about life insurance, they often focus on the primary benefit: providing financial protection for their loved ones. But with a participating whole life policy like KSKJ Life’s Precision Plan Plus, there’s an extra feature that offers additional value – dividends. Here’s how they work and what they can mean for you.

What Are Life Insurance Dividends?

Dividends in a life insurance policy are essentially a return of premium paid to policyholders by participating life insurance companies, such as KSKJ Life. These companies can choose to share a portion of their financial surplus with policyholders.

How Do Dividends Work?

If the insurance company performs well, participating whole life policyholders may receive a dividend. These are typically declared on an annual basis and are based on a variety of financial factors. Unlike interest on a savings account, these dividends aren’t guaranteed every year, but they offer the potential for added value

Why Choose a Policy with Dividends?

Why Choose a Policy with Dividends?

A participating whole life policy with dividends, like KSKJ Life’s Precision Plan Plus, provides more than basic coverage. It offers flexibility and the potential for growth, which can be especially valuable for people who want to build financial resources while having a solid insurance foundation.

HOW CAN YOU USE YOUR DIVIDENDS?

One of the great things about dividends is that they’re flexible.

Here are some common ways policyholders can use them:

1. Buy Additional Paid-Up Insurance: Policyholders can use dividends to purchase additional paid-up insurance, increasing the policy’s death benefit and cash value over time.

2. Accumulate Interest: Some people choose to leave dividends with the insurer to accumulate interest, creating a small savings feature that’s separate from the main policy. According to LIMRA, policies that accumulate interest on dividends can grow at a compounding rate, offering an excellent way to enhance long-term savings.

3. Reduce Premiums: Dividends can help offset the cost of premiums, effectively reducing the out-of-pocket amount the policyholder needs to pay.

4. Take as Cash: Policyholders can also opt to receive dividends as cash payments, which can be used in any way they see fit.

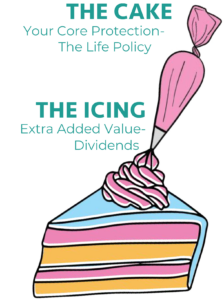

The Cake and The Icing

The Cake and The Icing

At the core of your whole life policy is the death benefit, which is guaranteed and tax-free to your beneficiaries. This is the cake—it’s designed to provide lasting financial security to your loved ones.

But here’s where it gets sweeter: KSKJ Life’s Precision Plan Plus offers all of the same guarantees and features of our standard Precision Plan products, but also includes dividends. These dividends are the icing on the cake—an added bonus that enhances what you already have, making your policy even more valuable.

By choosing a policy with dividends, you’re not just securing the future of your loved ones—you’re also adding a layer of financial growth and flexibility to your life insurance coverage and protection for your loved one. Sweetening the deal, indeed!

With The Precision Plan Plus you can: