October 29, 2024

How an Immediate Income Annuity can provide reliable income now

Today’s uncertain market, fluctuating interest rates, political climate, and changing tax and social security policies are leaving many retirees concerned about their long-term retirement income. Did you save enough? Did you choose the right financial products to cover you beyond Social Security and your 401K? Do you have enough money for your retirement bucket list? How do you weather economic uncertainty with confidence? Making the most of retirement planning decisions can feel stressful and confusing, but the reality is that you have a lot of flexible options, whether you’re already retired or you’re about to retire and are looking for additional income before taking Social Security. A Single Premium Immediate Annuity (SPIA) can be a great tool to protect you from market volatility and fully maximize your savings, with guaranteed retirement income for life.

The retirement income gap: Did you accurately estimate how much retirement income you need?

The amount of money you need for retirement depends on your current cost of living and lifestyle, and your other sources of income, but if you plan to retire at 65, experts typically recommend you have 8-10xs your annual salary saved.

However, according to a recent survey of American retirement plan participants, only 1 in 10 correctly estimated the 70% to 80% income replacement rate recommended to maintain their same standard of living upon retirement. Despite retirees’ confidence in their ability to know how much to withdraw to cover living expenses, 87% believe they will need some level of help withdrawing money from their retirement accounts. Additionally, new data suggests up to 53% of Americans aren’t sure how Social Security fits into their retirement plan.

The retirement income gap impacts around 80% of older adults, according to the National Council on Aging (NCOA). It’s being worsened by inflation, rising healthcare costs, and a need for long-term care services, but the NCOA notes fully maximizing available benefits, strategically filing for Social Security, and harnessing tools for financial security are the best ways to make your retirement money work for you.

What is a Single Premium Immediate Annuity (SPIA)? How can it help address retirement income gaps?

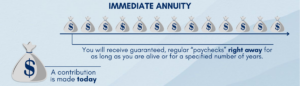

A Single Premium Immediate Annuity, or SPIA for short, is a type of annuity that offers you income immediately.

Immediate annuities are best for individuals who are already in or close to retirement because they offer guaranteed income for life or a set period of time. This kind of annuity is designed to start paying income as soon as you start the policy. KSKJ Life offers a Single Premium Immediate Annuity (SPIA) with various payout options.

Here are the basics of how a SPIA works:

Watch the video below to find out more:

What are the biggest benefits of a Single Premium Immediate Annuity (SPIA)?

Although there are a lot of SPIA myths out there, it can be a useful tool for almost anyone approaching or in retirement. In fact, we recommend some benefits for considering an annuity before 65 if you can. Ultimately, the key is to utilize a SPIA as part of a well-rounded retirement financial strategy.

The biggest benefits SPIAs offer are:

-

-

- Predictable, scheduled payouts

- Security – extra protection against unexpected financial storms

- Low risk – shields you from any market fluctuations

- No ongoing fees

- Guaranteed income for life *

- Flexibility – flexible payout terms and timeframes

- Tax advantages over other retirement savings options

- Spousal or beneficiary protections

-

Overall, SPIAs are attractive for those looking for financial security and simplicity with a steady, recurring retirement income stream.

How does a Single Premium Immediate Annuity (SPIA) support my unique retirement goals?

Your retirement goals are as unique as you are. Through an immediate retirement income, a SPIA can help address many common retirement goals, including:

Supplement Your Social Security Benefits

Social Security payments typically make up only around 30% of an individual retiree’s income. Almost 9 in 10 Americans aged 65 receive Social Security, and 45% of those who are single rely on it for 90% or more of their income. Although 2025 will bring a slight increase in Social Security payments, the 2.5% cost of living adjustment is the lowest adjustment since 2021 due to inflation slowing, and many retirees may be worried about the impact on their finances.

SPIAs can be a great tool to bridge this Social Security retirement income gap and offer an additional monthly income source.

Make Sure You Have a Predictable Income to Cover Everyday Expenses

One of the core benefits of a SPIA is a guaranteed, predictable monthly income amount. That income can help you cover those everyday bills during your retirement days like rent/mortgage, taxes, utilities, groceries, medical bills, and more. An annuity can be a useful way to help subsidize your other retirement income streams where Social Security or a 401K may fall short in covering your monthly expenses.

Guarantee You Have Income For Life

SPIAs can offer you a retirement income for life and won’t run out at any point*, regardless of changes in the market or how long you live.

Protect Your Retirement Income From Market Volatility and Unpredictable Changes in Interest Rates

For those looking for a predictable, low risk option for a portion of their retirement savings, immediate annuities like a SPIA offer a steady, reliable income source.

Preserve Your Assets and Securely Grow Your Wealth

Because your financial wealth isn’t exposed to market volatility while in an annuity, you’re able to fully preserve your assets and grow your money in a low risk, predictable way.

Simplify Your Financial Management in Retirement

An annuity like a SPIA can offer peace of mind and help alleviate some of your ongoing financial management responsibilities during retirement. It can minimize budgeting – you have predictable, regular income payments every month. You also don’t have to spend as much time monitoring accounts and the market, managing investments, or making withdrawal decisions.

Give You a “Playcheck” to Cover Your Retirement Bucket List

An annuity like a SPIA also offers you a great opportunity beyond the bills to fund your retirement dreams. From that trip you always wanted to take to leaving a legacy for your grandchildren or philanthropy goals, annuities also offer you a flexible path to a retirement “playcheck”.

How does a Single Premium Immediate Annuity (SPIA) compare to a CD or a savings account?

A SPIA can offer unique benefits for retirement income compared to keeping money in a savings account or buying a CD.

The benefit of a savings account is that your money is liquid, so you have easy access to it at any time. The drawback is that it usually has a low interest rate and is not meant to be a financial tool to grow your money. A CD will offer a higher interest rate than a savings account, but offers limited liquidity, and you’ll incur a penalty for early withdrawal. In certain circumstances, there is also a possibility a CD can be retracted by your bank.

A SPIA typically offers a higher interest rate than a savings account or CD. Instead of holding your money for a period of time, a SPIA begins to pay you a steady stream of income payments immediately that continue throughout your retirement.

How does a Single Premium Immediate Annuity (SPIA) Compare to Other Types of Annuities, Like a Multi-Year Guaranteed Annuity (MYGA**)?

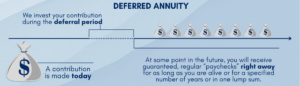

A Single Premium Immediate Annuity (SPIA) is different from a Multi-Year Guaranteed Annuity (MYGA) because a SPIA is an immediate annuity and offers you immediate income, whereas a MYGA is a deferred annuity and offers you income at a set later date.

A deferred annuity like a MYGA will delay payments until you choose to receive them, which would typically be once you actually retire. During the savings phase, you would put money into the account, and during the income phase, the plan would relinquish your payouts, or “paychecks.” KSKJ Life offers a number of deferred fixed annuity options.

Other Ways a SPIA Can Help Your Retirement Goals: A Split Annuity Strategy

Beyond the basics, there are a few different ways an immediate annuity can offer you some flexible and creative ways to make the most of your savings depending on your age, the amount you have to contribute to a premium, your existing retirement investments, and your overall retirement goals. One of those options is through a split annuity strategy. A split annuity strategy is basically dividing your funds between an immediate annuity (SPIA) and a deferred annuity (MYGA). For certain retirement situations, this structure can offer you unique benefits to maximize the value of your savings.

The Benefits of an Annuity Assessment

Curious how an immediate annuity or other type of annuity could help you achieve your retirement goals? A 15-20 minute free Annuity Assessment via email or phone can be a great place to start. Don’t miss out on our high annuity rates; still available for a limited time, KSKJ Life is offering a Multi-Year Guaranteed Annuity up to 5.00% APY***.