June 23, 2022

The Newest Audience for Life Insurance

While student debts, starting families or new jobs and buying property might seem like enough to focus on as a millennial (i.e., people born 1981-1998, aged 25-41), the global pandemic has put a twist on how we all do life and that includes a new pivot for millennials, life Insurance. Most people don’t spend their time thinking about retirement or their mortality, but Covid-19 brought upon loss in many ways either collectively or personally. This loss forced us to take note of our lives and if and how our families would survive without us.

The Hesitation

Traditionally, millennials have taken a pause when it comes to life insurance. According to a 2022 Barometer Study by LIMRA, overestimating the cost was a concern across generations but second to that, both millennials and Gen Z (born 1997-2003) felt uncertain about their need for insurance or what type to choose.1 Life insurance companies have seen a downward shift since 2021 encompassing all groups but significantly more with the under 40 age group. Experts in the industry theorize why.

People most often buy life insurance at key milestones in their life, and as younger people, saddled by student debt and underemployment, continue to push back their timelines for owning homes and starting families (if they do either at all), they might be buying life insurance later too. But “even if you take into account homeownership or marriage status, there’s still a disconnect between how many people are buying it now versus how many people bought it 20, 30 years ago,” said Niall Williams, an analyst at the tech-analytics firm CB.2

The Numbers

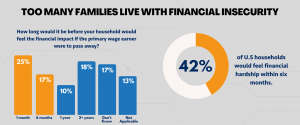

A joint study between nonprofit industry trade associations, LIMRA and Life Happens, reports Millennials (ages 25-41) seem to be most influenced by the pandemic when it comes to coverage. 45% of millennials said they are more likely to buy life insurance due to COVID-19 compared to only 15% for Baby Boomers (born between 1946 and 1964) and only 31% of Gen X (born between 1965-1980) consumers. With 42% of Americans saying they would face financial hardship within six months if their primary wage-earner were to die unexpectedly, young Americans, in particular millennials, are at highest risk as more than half of this group have no life insurance.3

Young and debating your need? Think about this: “The question of who needs life insurance is very personal, but an easy way to know if you need life insurance is to consider if someone would suffer financially if you were to pass away,” Faisa Stafford, president and CEO of industry group Life Happens, said in an email. “If the answer is yes, then you should consider life insurance.” She recommends focusing on two main issues: replacing your income and repaying your debts if you die. That means thinking ahead to cover your growing financial commitments as your life changes.4

The Good News

So, what is the good news, you might ask, for millennials contemplating life insurance?

- Well, for one, financial security. You might have just started a family or had a new baby. Are your parents aging? Finally bought that house or condo with a shiny new mortgage or are you still paying on a student loan? Should anything happen to you unexpectedly, securing life insurance is one proactive way to assure your loved ones aren’t burdened with any of these financial responsibilities. Also, as a millennial, you might not have started that retirement or savings account quite yet, leaving your family vulnerable. You might not have thought about it in this way, but insurance can be the safety net in a time of need.

- Your age can work in your favor. As a millennial, you are more than likely to be considered in good health. Good health can mean you are a lower-risk candidate which in turn can get you more affordable rates. Not to mention, life insurance rates increase an average of 4.5-9% every year you put off buying a policy.5 The older you get, the more risk you pose to your life insurance company. The result is that a policy for a 25-year-old is likely to be much less expensive than the same coverage for a 45-year-old.4

With their strong sense of responsibility reaching far and wide, millennials are embracing their duty to protect and secure what they love, both now and in the future, with life insurance. There’s room for growth in this age group but the trend is going in the right direction.

1: 2022 Barometer Study 2: The Atlantic 7/30/2021 https://www.theatlantic.com/technology/archive/2021/07/great-life-insurance-rebrand/619603/ 3: LIMRA 3/23/21 https://www.limra.com/en/newsroom/news-releases/2021/study-finds-covid-19-spurs-greater-interest-in-life-insurance/ 4: Nerd Wallet 11/18/2020 https://www.nerdwallet.com/article/insurance/millennial-life-insurance 5: Policy Genius 1/27/2022 policygenius.com/life-insurance/life-insurance-rates-by-generation/

Looking for more information on a policy with

KSKJ Life?

Connect with us today!