January 17, 2025

Laddering-A Smart Strategy for Stability and Growth

In an unpredictable economy, many savers and retirees are looking for secure ways to grow their money while maintaining flexibility. One strategy gaining popularity is “Laddering”. A laddering strategy combines the safety of Multi-Year Guaranteed Annuities (MYGAs) with a structure designed for liquidity and long-term growth potential. Let’s dive into how this works and why it might be a good fit for your financial goals.

What Is Laddering?

What Is Laddering?

A laddering strategy involves splitting a single larger contribution into multiple MYGAs with staggered term lengths. Instead of locking all your money into one annuity with a single maturity date, laddering creates a sequence of annuities that mature at different times. This provides greater liquidity, flexibility, and the potential to redirect funds at potentially higher future interest rates.

Here’s an example:

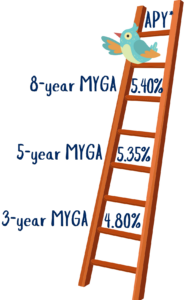

-$50,000 into a 3-year MYGA

-$50,000 into a 5-year MYGA

-$50,000 into a 8-year MYGA

As each MYGA matures, you can decide whether to withdraw funds, use them for income, or roll over in a new annuity. This approach balances the benefits of locking in higher rates for longer terms with the flexibility of having funds available sooner.

How Laddering Works: A Real-Life Example

Imagine Jane, a 65-year-old retiree, with $150,000.

She splits her funds as follows:

| $50,000 into a 3-year MYGA at 4.80% APY*  |

$50,000 into a 5-year MYGA at 5.35% APY*  |

$50,000 into a 8-year MYGA at 5.40% APY*  |

After three years, the first MYGA matures, giving Jane the flexibility to purchase another annuity or withdraw funds. Meanwhile, the other two MYGAs continue to grow at their guaranteed rates. By the time the 5-year MYGA matures, she has another opportunity to reassess her financial strategy. This staggered approach ensures Jane has regular access to her money while still enjoying the benefits of long-term growth and security.

Why Consider Laddering?

Laddering is ideal for individuals who:

-Want to balance long-term growth with short-term access to funds.

-Are concerned about locking in rates for an extended period.

-Need predictable, steady cash flow for retirement or other financial goals.

CURIOUS IF LADDERING IS RIGHT FOR YOU?

Reach out to us today to create a customized strategy tailored to your needs. With the right plan in place, you can enjoy the perfect balance of growth, security, and flexibility.